Saudi Arabia’s “Sports Strategy” Hits the Brakes, Is the “Saudi Money” Bubble Bursting?

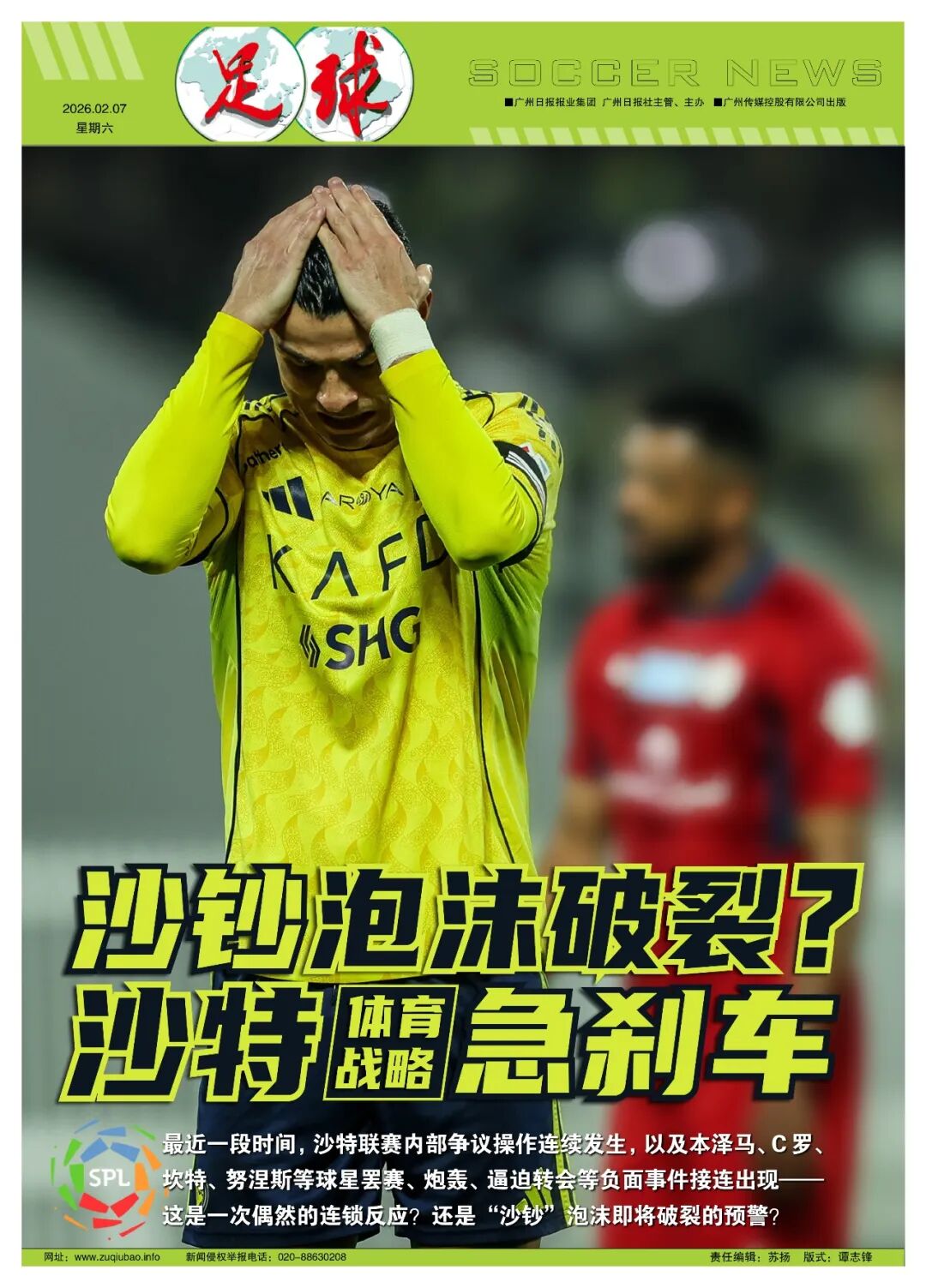

Written by Han Bing In recent years, the Saudi Pro League earned the nickname “Saudi Money League” because of its enormous spending and the influx of many popular superstars. Yet recently, ongoing internal turmoil combined with negative episodes involving stars like Benzema, Ronaldo, Kanté, and Núñez—such as boycotts, public outbursts, and pressured transfers—have surfaced, making this league, once hailed as the “world’s fifth league,” seem on the verge of falling apart.

What exactly is going on? Is this a mere coincidence of events, or a warning sign of the league’s impending collapse? Who has truly burst the “Saudi Money” bubble?

To be precise, Ronaldo’s strike is just the “peak event” in a series of recent crises facing the Saudi league. Not only football, but Saudi Arabia’s heavy investments in golf, F1, boxing, professional wrestling, esports, winter sports, and even large-scale sporting events are all being drastically scaled back. In fact, it’s not just the “Saudi Money” league; the national-level “sports strategy” of Saudi Arabia is confronting major challenges.

Saudi Arabia’s “sports-driven national strategy” gained global influence starting with signing Ronaldo in early 2023. Three years later, Ronaldo’s strike once again drew worldwide attention to the Saudi league but may mark a turning point toward a comprehensive contraction of Saudi Arabia’s “sports national strategy.”

In the summer of 2023, the Saudi Public Investment Fund made astronomical investments to bring Neymar, Benzema, Kanté, and over 30 other international stars to the Saudi league. The investment reached €944 million, surpassing Ligue 1, Bundesliga, and La Liga, and ranking third worldwide alongside Serie A. However, after just one season, the investment scale and recruitment approach dramatically shifted. In the summers of 2024 and 2025, the Saudi league still maintained high spending, attracting prime players like Toni, Cancelo, Aubameyang, Núñez, Theo, Félix, Coman, and Reijnders from the top four leagues.

Starting last year, the Saudi league introduced strict financial regulations, limiting club spending to 80% of their income this season, with plans to reduce it further to 70%. During the winter transfer window, the four major Saudi clubs faced financial constraints—Al Hilal relied on private member “sponsorship,” while Al Ittihad had to “offload” Benzema and Kanté before making new signings—these restrictions are direct results of the financial rules.

At the same time, the exodus of stars has gradually intensified. From Neymar and Talisca early last year to Mitrović, Lodi, Laporte, Durán, Aubameyang, Firmino last summer, and now Kanté, Cancelo this winter, along with Núñez still seeking an exit, the Saudi league’s appeal is steadily declining. Ronaldo’s strike and potential departure are merely the latest signs of the league’s strategic downsizing and bubble bursting.

Western media generally believe that Saudi Arabia will focus its football investments on the 2030 World Expo and the 2034 World Cup, making it unlikely to continue competing with the top five leagues. The Saudi league will move away from overreliance on superstar signings, instead centering on more cost-effective stars (such as Salah), building a league dominated by young foreign players and local talent.

Of course, the downsizing of the football league is just one aspect of the recent shift in Saudi Arabia’s “sports national strategy.”

Launched in 2022, the LIV Golf League kicked off the “sports-driven national strategy” with billion-euro annual salaries and multi-million-euro prizes. Subsequently, Saudi Arabia heavily invested in football, F1, boxing, professional wrestling, winter sports, and bid for major events like the Asian Cup, Asian Winter Games, and World Cup. Meanwhile, the broader “Vision 2030” plan aimed at upgrading infrastructure both physically and technologically.

However, such an unprecedented national strategy relies almost entirely on energy export revenues supported by oil prices. Now, with oil prices at $60 per barrel—less than half the 2022 peak of $139 per barrel—Saudi Arabia can no longer sustain this massive spending model, shifting from pursuing mega-projects to more rational, return-focused investments.

The first to face cuts were the “Vision 2030” mega infrastructure projects. The futuristic city designed to house 9 million people, The Line—a 170 km linear city—has seen less than 10% of its planned construction preserved, pivoting instead to dense server farms rather than smart city development. The Trojena winter resort in northwest Saudi, Riyadh’s central world’s largest single skyscraper Mukaab, and the 1008-meter-tall Jeddah Tower have all halted construction. Smaller-scale sports events only began feeling the impact earlier this year.

Among LIV Golf’s six superstar players, two—Kopeka and Reed—have already left. The tournament format shifted from 54 holes to 72 holes to align with PGA standards, attracting golfers seeking PGA points rather than huge salaries and prizes. Besides abandoning the 2029 Asian Winter Games, Saudi Arabia also withdrew from hosting the Handball World Super Cup, canceled bids for the 2029 and 2031 Handball World Championships, and paused a joint venture with World Athletics to promote athletics championships and the Golden League. Saudi also canceled a 12-year Olympic esports hosting agreement, and investment in overseas holdings like Newcastle is sharply declining.

Saudi sports authorities’ strong response to Ronaldo’s strike confirms the shift in the “sports national strategy.” Although Al-Nassr still hopes to retain Ronaldo and promises to sign Casemiro or Salah in the summer, the goal is to maintain Ronaldo’s role as the 2034 World Cup ambassador to continue global influence, rather than sustaining him as a “superstar” centerpiece of the Saudi league ecosystem.

Saudi Arabia’s “sports national strategy” will streamline and optimize investments, focusing on expanding influence in various sports federations, controlling broadcasting rights, and shaping sports governance. At least, Saudis hope that future Saudi football and sports will no longer be just a “big spender” but will hold a meaningful voice in the global football and sports landscape.

Wonderfulshortvideo

The footwork, the finish 🤌

Did you get it? 🤔😅

Haaland’s movement 🥵

Which counterattack is

When you use your girlfriends shower 🚿 @Emily Bourne @LUSH

Neymar highlights neymar edit neymar lamine yamal celebration

Arsenal 1-0 chelsea havertz goal

Links

Links

Contact

Contact

App

App